Payroll withholding calculator 2023

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of.

The Tax Impact Of The Inflation Reduction Act

Discover ADP Payroll Benefits Insurance Time Talent HR More.

. 2023 payroll withholding calculator Senin 05 September 2022 Edit. The amount of income tax your employer withholds from your regular pay. Tips For Using The IRS Payroll Withholding Calculator.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. 2021 Tax Calculator. Start the TAXstimator Then select your IRS Tax Return Filing.

For employees withholding is the amount of federal income tax withheld from your paycheck. How to calculate annual income. Ad Compare This Years Top 5 Free Payroll Software.

2023 payroll withholding calculator Senin 05 September 2022 Edit. 250 minus 200 50. The Tax withheld for individuals calculator is.

Payroll withholding calculator 2023 Senin 12 September 2022 Edit. Prepare and e-File your. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. It will be updated with 2023 tax year data as soon the data is available from the IRS. Estimate values of your 2019 income the number of children you will.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Federal Taxes Withheld Paycheck based estimate. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Free Unbiased Reviews Top Picks. Subtract 12900 for Married otherwise. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Free salary hourly and more paycheck calculators. Get Started With ADP Payroll. Ad No more forgotten entries inaccurate payroll or broken hearts.

Tax withheld for individuals calculator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Tips For Using The IRS Payroll Withholding Calculator.

Time and attendance software with project tracking to help you be more efficient. That result is the tax withholding amount. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

A 2020 or later W4 is required for all new employees. 2022-2023 Online Payroll Tax. Prepare and e-File your.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. There are 3 withholding calculators you can use depending on your situation. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

Check your National Insurance payroll calculations. Thats where our paycheck calculator comes in. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Then look at your last paychecks tax withholding amount eg. All Services Backed by Tax Guarantee. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Ad No more forgotten entries inaccurate payroll or broken hearts. Ad Process Payroll Faster Easier With ADP Payroll. Choose the right calculator.

Time and attendance software with project tracking to help you be more efficient. Calculate Your 2023 Tax Refund. The Calculator will ask you the following questions.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Free Unbiased Reviews Top Picks. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

For example if an employee earns 1500. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Ad Compare This Years Top 5 Free Payroll Software. The maximum an employee will pay in 2022 is 911400. 250 and subtract the refund adjust amount from that.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 2022 Federal income tax withholding calculation. Free Unbiased Reviews Top Picks.

Prepare and e-File your.

Capital Allowances Capital Cost Recovery Across The Oecd

2022 Federal Tax Deadlines For Your Small Business

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Payroll Updates For Nz New Tax Year 2022 2023 Keypay

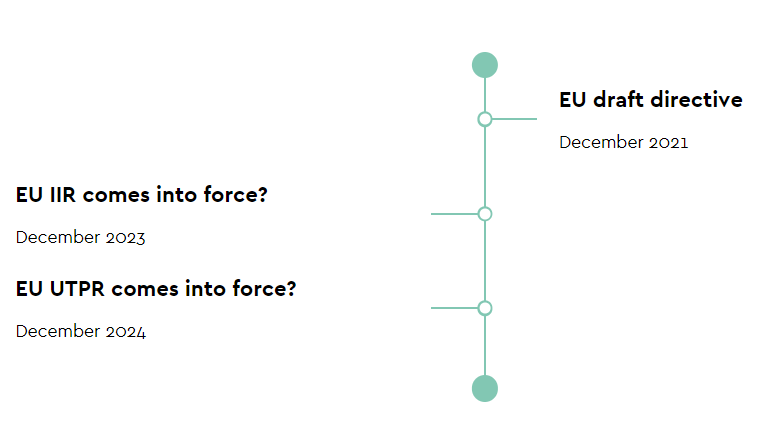

Beps Pillar Two Globe Rules Lexology

Important Things To Keep In Mind While Filing Your Income Tax Return For The Tax Year 2022 2023

South Africa Corporate Taxes On Corporate Income

Payroll Template Free Employee Payroll Template For Excel

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

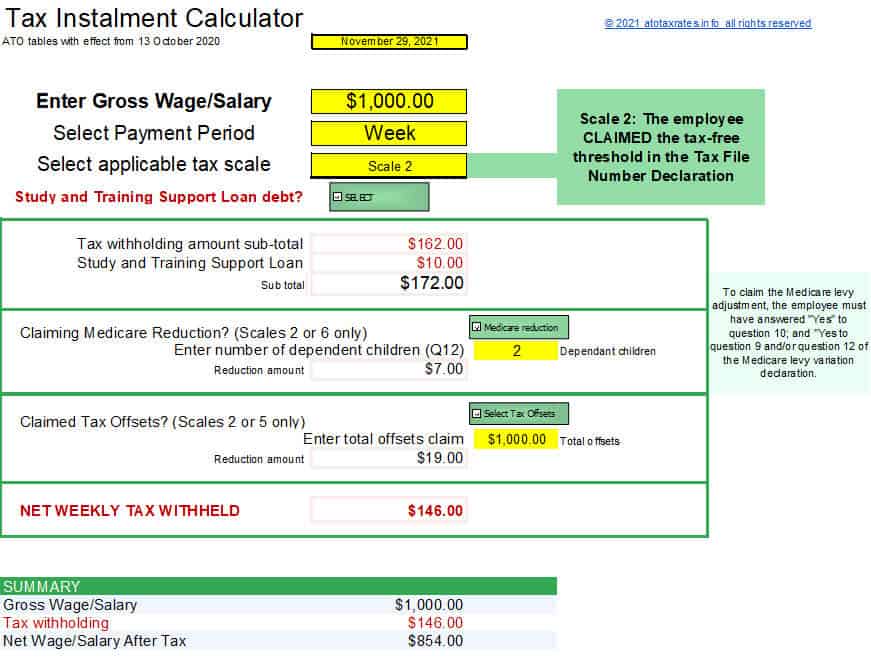

Ato Tax Tables 2022 Atotaxrates Info

Capital Allowances Capital Cost Recovery Across The Oecd

Social Security Changes That May Be Coming For 2023

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

Payroll Updates For Nz New Tax Year 2022 2023 Keypay

Death In The Family Turbotax Tax Tips Videos